Accumulated Depreciation is a contra-asset account that reduces the asset’s gross value. It is reported on the Balance Sheet, alongside the asset’s gross value. The Depreciation Disclosure includes Accumulated Depreciation and is essential for stakeholders. Accumulated Depreciation is used to calculate the asset’s net book value. It is a critical component of the Financial Statement, providing a clear picture of the company’s financial position. In the context of financial reporting, Accumulated Depreciation is a critical component of the Financial Statement.

Understanding Depreciation Basics

The book value is important for determining the gain or loss if the asset is sold. See our article on accounting for the disposal of fixed assets for more information. Accumulated depreciation can be useful in calculating the age of a company’s asset base but it’s not often disclosed clearly on financial statements. From an accounting perspective, depreciation is the process of converting fixed assets into expenses. Also, depreciation is the systematic allocation of the cost of noncurrent, nonmonetary, tangible assets (except for land) over their estimated useful life.

- To be more precise, accumulated depreciation and depreciation expense help us observe how a business uses and values its resources.

- If the useful life is short, then calculated Depreciation will also be less in the early accounting periods.

- Investors should pay close attention to ensure that management isn’t boosting book value through depreciation-calculating tactics.

Amortization vs. depreciation: What are the differences?

Understanding the difference between these two concepts is vital for accurate financial reporting and informed decision-making, as it reveals more about an asset’s life cycle. Depreciation expense is a portion of the capitalized cost of an organization’s fixed assets that are charged to expense in a reporting period. It is recorded with a debit to the depreciation expense account and a credit to the accumulated depreciation contra asset account. Another difference is that the depreciation expense for an asset is halted when the asset is sold, while accumulated depreciation is reversed when the asset is sold.

Example Financial Statements

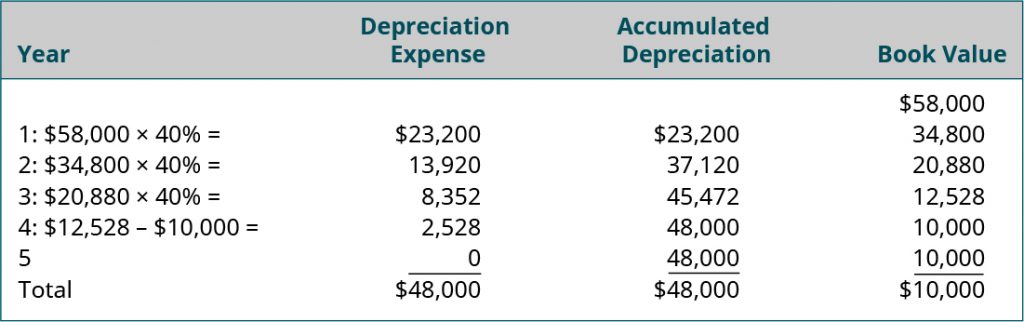

Similar to the double-declining balance method, the sum of the years’ digits method results in higher depreciation expenses in the earlier years of an asset’s life. If an asset is depreciated for financial reporting purposes, it’s considered a non-cash charge because it doesn’t represent an actual cash outflow. And, the depreciation difference between accumulated depreciation and depreciation expense charges still reduce a company’s earnings, which is helpful for tax purposes. Under this accelerated method, there would have been higher expenses for those three years and, as a result, less net income. This is just one example of how a change in depreciation can affect both the bottom line and the balance sheet.

Is depreciation the same as amortization on the income statement?

However, being able to properly manage the costs and navigate the tax complexities can be challenging. Carrying value is the net of the asset account and the accumulated depreciation. Salvage value is the carrying value that remains on the balance sheet after which all depreciation is accounted for until the asset is disposed of or sold. Salvage value is what a company expects to receive in exchange for the asset at the end of its useful life. The total amount depreciated each year, which is represented as a percentage, is called the depreciation rate. For example, if a company has $100,000 in total depreciation over an asset’s expected life, and the annual depreciation is $15,000, the depreciation rate would be 15% per year.

The account Accumulated Depreciation is a contra asset account because it will have a credit balance. The credit balance is reported in the property, plant and equipment section of the balance sheet and it reduces the cost of the assets to their carrying value or book value. Depreciation expense is the periodic depreciation charge that a business takes against its assets in each reporting period. The intent of this charge is to gradually reduce the carrying amount of fixed assets as their value is consumed over time. In essence, an expenditure for a fixed asset is initially recorded as a long-term asset, and is then charged to expense through the income statement over the estimated useful life of the asset. The useful life of the asset and the depreciation method used on it are generally set based on the fixed asset classification to which it is assigned (such as Furniture and Fixtures or Vehicles).

Accumulated depreciation is found on the balance sheet and explains the amount of asset depreciation to date compared to the “original basis,” purchase price, or original value. You calculate it by subtracting the accumulated depreciation from the original purchase price. Some people use the terms depreciation versus depreciation expense interchangeably, but they are different. Depreciation expense is the amount of loss suffered on an asset in a section of time, like a quarter or a year. Accumulated depreciation is the sum of the depreciation recorded on an asset since purchase. Depreciation represents an asset’s decrease in value over a specific timeframe.

As part of the year-end closing, the balance in the depreciation expense account, which increases throughout the client’s fiscal year, is zeroed out. During the next fiscal year, depreciation charges are once again housed in the account. Business clients need a lot of assets to run their company and they turn to you for help in ensuring tax compliance and to mitigate their tax liabilities when acquiring property. Accumulated depreciation is not a current asset, as current assets aren’t depreciated because they aren’t expected to last longer than one year.

Leave a Reply